The smart Trick of Trace Zero That Nobody is Talking About

Table of ContentsTrace Zero for DummiesGetting My Trace Zero To WorkExcitement About Trace ZeroExamine This Report about Trace ZeroA Biased View of Trace Zero

Carbon accountancy enables businesses to prosper in the net-zero transition and take care of climate-related risks. Organizations with robust carbon bookkeeping methods are much better positioned to satisfy need from clients, capitalists and regulatory authorities (like the EU CBAM and UK CBAM), and can determine threats and competitive chances. Nevertheless, there are limitations to carbon bookkeeping if it's not done correctly.Organizations require to utilize their carbon bookkeeping information and understandings to take the best steps., and much less than half are gauging their supply chain emissions.

Recurring mix factors resemble grid-average aspects yet are computed based upon power generated from non-renewable resources, as an example, oil, gas, coal or other sources not backed by EACs. If recurring mix variables are not readily available for a region, then conventional grid-average elements must be made use of, because they are in the conventional location-based method.

3 Easy Facts About Trace Zero Explained

Factor 5 needs that certifications be sourced from the exact same market in which the reporting entity's electricity-consuming procedures lie and to which the tool is applied. This indicates that it would be incorrect to allot certifications issued in the US to intake in the UK (carbon accounting). If the organization has power acquisition contracts, the certifications may not exist

Baseline-and-credit systems, where standard discharges degrees are defined for specific regulated entities and credit ratings are released to entities that have actually decreased their exhausts below this level. It is various from an ETS in that the discharge decrease end result of a carbon tax is not pre-defined however the carbon rate is. Attributing Systems issue carbon credit ratings according to an accounting method and have their very own windows registry.

For governments, the choice of carbon prices type is based upon nationwide situations and political realities - carbon accounting. Click Here In the context of obligatory carbon pricing efforts, ETSs and carbon taxes are one of the most common kinds. One of the most ideal effort kind depends upon the certain conditions and context of an offered jurisdiction, and the tool's policy objectives should be straightened with the more comprehensive national economic top priorities and institutional capabilities

Indirect carbon prices efforts are not presently covered in the State and Fads of Carbon Rates collection and on this website.

Top Guidelines Of Trace Zero

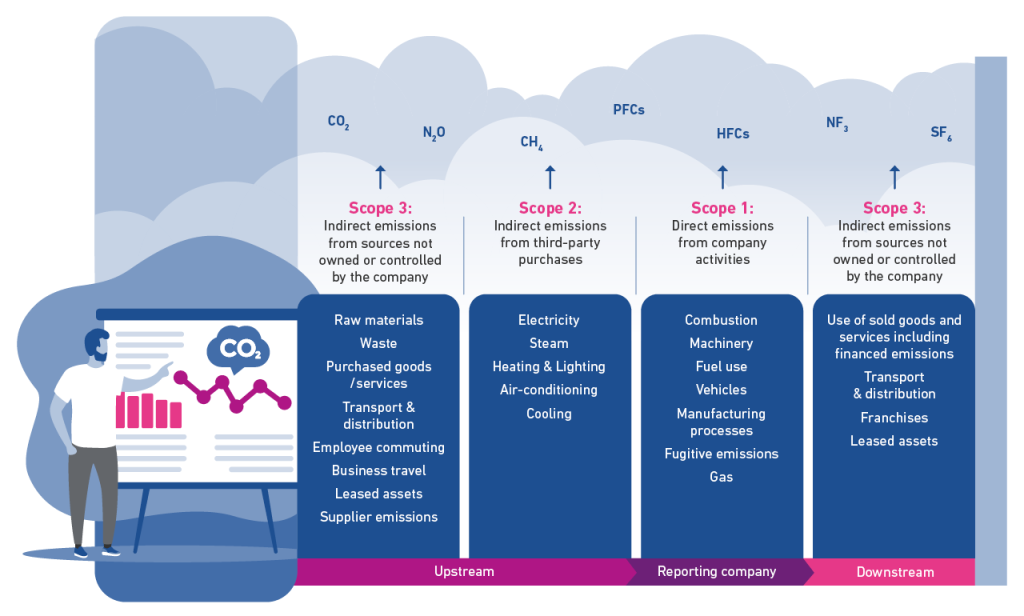

Carbon bookkeeping measures exhausts of all greenhouse gases and includes Carbon dioxide, methane, nitrous oxide, and fluorinated gases. Gases various other than carbon are expressed in terms of carbon matchings.

As an example, in 2012, the UK coalition federal government introduced necessary carbon coverage, needing around 1,100 of the UK's biggest provided firms to report their greenhouse gas emissions each year. Carbon accountancy has actually given that climbed in importance as even more laws make disclosures of exhausts mandatory. Therefore, there is a higher fad in reporting requirements and regulations that demand business comprehend where and exactly how much carbon they emit

ESG frameworks gauge a business's non-financial performance in ecological, social and administration classifications. Carbon accountancy is an important component of the E, 'Setting', in ESG.

The Best Guide To Trace Zero

A carbon matching is computed by transforming the GWP of various other gases to the equivalent quantity of co2 - carbon footprint tracking. As stress climbs to lower emissions and reach ambitious decarbonisation objectives, the function of carbon accounting is significantly crucial to a service's success. In enhancement to environment promises and regulatory restrictions, the price of carbon is progressively increasing and this further incentivises the economic sector to determine, track and decrease carbon emissions

Carbon bookkeeping allows companies to identify where they are launching the most exhausts (https://www.easel.ly/browserEasel/14616386). This enables them to prioritise decarbonisation approaches on where they will certainly have the best impact. carbon accountancy identifies one of the most powerful levers for decarbonisation. Carbon bookkeeping is the very first and vital step to exhausts decrease, which is essential if we intend to stay below 2 degrees of global warming.